Well...we filled the application out for our construction loan as I last wrote and the branch manager ran some numbers and assured us that there was no way it wouldn't be approved. So imagine my surprise when I talk to him today and he says that it didn't go through...He says the "Senior VP" wouldn't approve a 90/10 construction loan and would require the full 20% down because of my student loans...

I guess this "Senior VP" doesn't know much about student loans. I am a Physician Assistant...PA's, NP's and MD's rack up a TON of student loans...most loan officers that know what they are doing will consider the income we bring in to be acceptable and not consider the student loans "bad debt."

Anyways, I asked why this all of the sudden was an issue and it seems that the person who shot this down made a very wrong assumption about my student loan payments after viewing our credit reports. I had consolidated my student loans last year and I guess the person didn't read the report very closely and read each disbursement of my student loans during grad school as separate loans...so basically there were what appeared to be SEVERAL separate student loans which if you add up end up being WAY over what I report that my student loans/monthly payment are. The gentlemen we were working with at this bank says this could change things and asked if I had proof of this. So I emailed him the latest Loan Summary Report and will wait and see if it makes a difference. If not, someone really needs to evaluate their job because they can't add or read...

If this falls through, we have another option to finance this thing that was already approved, but we really would rather not as it is more costly and complicated. However, it would be our only choice because we absolutely cannot do the full 20% because it would significantly decrease our financial security.

Hope to report better news tomorrow...for now, the wind has been taken out of our sails and apparently for no good reason.

Tuesday, January 29, 2013

Thursday, January 24, 2013

Making some progress

Over the past week we got some more firm numbers from the lender that we were having doubts about and he was very honest and told us that we should "take the other offer and run!" He said that he hasn't seen a conventional 90% financing construction loan in years and if we had one offered to us that we should take it immediately. So we met with the lender offering this loan this morning and filled out the official loan application. After running some numbers he feels there will be no issues obtaining this loan.

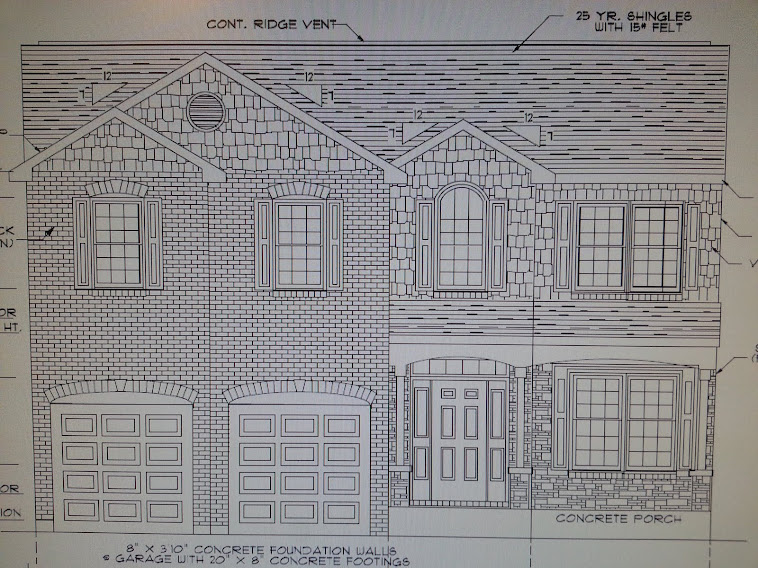

After this meeting we met with the builder and finally started working on the floor plans. He is going to take them to his designers over the next few days and see what they think. I've already alterred the plan we decided on today 3 different ways and submitted them to the builder since he left this afternoon! We are excited about one of the changes to the layout that I made, but are hoping it fits into the budget since it added a small extension off the back of the house to add a "breakfast room."

Glad we are making some progress! The builder wants to meet again next week since we can't get together over the next several days...my work schedule is a little different since I work in the ER. We can't wait to get out of this condo and are ecstatic not to have to spend another winter here. It is almost as cold in this place as it has been outside (in the teens and 20s this past week). Alright, so it isn't that bad, but I've lived in cheap apartments that were older than this that weren't nearly as drafty. You cannot walk around here without being bundled up. On top of that, the circuit breaker keeps tripping almost every other day on the furnace. The landlord had us call a repair guy who came out, charged the poor lady $200 and couldn't find a thing wrong...that's useful.

After this meeting we met with the builder and finally started working on the floor plans. He is going to take them to his designers over the next few days and see what they think. I've already alterred the plan we decided on today 3 different ways and submitted them to the builder since he left this afternoon! We are excited about one of the changes to the layout that I made, but are hoping it fits into the budget since it added a small extension off the back of the house to add a "breakfast room."

Glad we are making some progress! The builder wants to meet again next week since we can't get together over the next several days...my work schedule is a little different since I work in the ER. We can't wait to get out of this condo and are ecstatic not to have to spend another winter here. It is almost as cold in this place as it has been outside (in the teens and 20s this past week). Alright, so it isn't that bad, but I've lived in cheap apartments that were older than this that weren't nearly as drafty. You cannot walk around here without being bundled up. On top of that, the circuit breaker keeps tripping almost every other day on the furnace. The landlord had us call a repair guy who came out, charged the poor lady $200 and couldn't find a thing wrong...that's useful.

Sunday, January 20, 2013

The beginning...

After years of hard work through school and finally starting our lives together a little more than a year ago, we (Jared & Jenny) are finally looking to buy/build our first home! This blog will give anyone who cares to read it, a look into building a custom home and our personal journey. We will try to answer any questions as often as possible and look forward to any input anyone has. Pictures are sure to come as the construction process begins!

Here is what led us towards building a custom home:

We began our house search late last summer (July 2012). Jenny's former co-worker/friend now works as a realtor and has been with us since the beginning of the process. It started by looking at a few homes that were on the market. We saw some potential in some houses, but were just kicking the tires at first as we knew financially we wouldn't be ready to move on anything until late winter/early spring 2013. Throughout the process, we happened to look at a few foreclosed homes which normally would have been well out of our price range. We saw the potential in them, but ultimately couldn't get over the fact that almost each foreclosure we looked at had sat there for quite some time before being placed on the market and sustained significant water damage (in almost every one of them!). Some of them had been blatantly damaged by the previous owner on their way out. We can't imagine the feeling of losing your own home that you worked so hard for, so we can't say we were surprised.

Finally, our realtor set up an appointment to look at a new construction home that was placed on the market by a local "big builder." I won't use their name or any other builders name other than ours currently because I'm not trying to put anyone down. After seeing a new construction, we had a really hard time entertaining the thought of buying a formerly lived in home. We've seen a few that were well kept and didn't need much work, but the idea of being the first people to live in the house made it feel like it was truly "ours." We then spent the next couple of months talking with various "big builders" in the area and even designed a few houses with them. We narrowed out all but one of the big building companies and decided on one that was more local and had a great reputation for building durable homes. On top of that, my parents had lived in a home built by this company for the past 15 years without one problem in their home, so I knew the quality they produce. This builder also introduced the "Energy Star certification" process to us as well. At first, I thought it was just a sales pitch. Then I did some research on the actual savings you can earn on your utility bills by owning an Energy Star certified home. I even spoke with a couple who said that they went from a 1500 sq. foot home to an Energy Star certified home that was over twice the size of their own home and have never had a bill over $100. They said most of the time it failed to approach $70! We live in a 3 bedroom condo right now and it is very poorly constructed. Our last heating bill was $150...and we have the thermostat set at 67...and it never reaches that temp. From this point on, we knew we wouldn't be happy unless we had an Energy Star Certified home. Of course, the materials that must be used tend to run up the cost of building one of these homes, but we plan on being there for 10+ years and it should pay for itself plus add to resale value later.

Some of my co-workers had recommended building custom, but I didn't think we could afford it. Our realtor happened to know a custom builder that she recommended we meet with. By the time we met with him, we had spoken with 2 other custom builders and weren't making much progress with them. We weren't really sure what to expect and had all but decided to abandon the custom builder search for our first home and try that down the road for future homes. However, we agreed to meet and we had a completely different experience. For the first time during the home building process, we met a gentlemen who owns his own custom construction/rehabilitation company and he seemed like a genuine, honest guy. He owns RJ Homes, LLC here in Northern Kentucky. For the first time, we didn't feel like we were being coaxed into a situation where we had a very high likelihood of being screwed out of a lot of time and extra money. He only builds a handful of homes per year and we were able to see some of his work. We were very impressed and if we could budget it, were ready to move on. This meeting happened about 3-4 months ago.

Since then, we've been trying to hash out the financing. Since the market crashed, construction loans are hard to come by unless you have the full 20% down payment to throw at it. We only have about 10% we can put down for a down payment. On top of that, only small local banks tend to offer them. We tried several...and I mean several banks between RJ, our realtor, and ourselves making many phone calls. For the first 1.5 months, not a lot of luck. RJ then had the difficult decision to decide whether to call it quits or to decide if he was comfortable enough with the situation for him to take out the loan and have us buy it from him at the end. The risk to him if he took out the loan is that something falls through with the financing on our part and we are unable to buy it from him at the end...then he is stuck with a house that he didn't want and now has to sell. I am not going to pretend to know what way he was leaning, but we felt as though he may go through with it. Fortunately, before that decision had to be made, our realtor talked with a lender who said he could help. This was about 3 weeks ago. He knew a way where I only had to put a minimum of 3.5% down on the home at the end, but during the entire construction process, the full 20% of the cost of the home had to be "frozen" in an account with the bank providing the loan. Following closing of the house at the end, I could then retain my money and put as little as 3.5% down or however much I ended up wanting to put down. I intend on putting down 10%. That would work, but freezing the whole 20% was going to put us in a tight financial spot by not leaving us with much available money to live off of initially.

At this time, that was the only option as far as me taking out a construction loan. RJ, the lender, and I sat down and hashed out the details such as draw schedules, draw fees, closing (there were 2 closings in this construction loan...one at the beginning, and then another at the end when converting it to a mortgage...), and time constraints on the loan. RJ said it was sound on his end and if I worked out the details and was comfortable with it then we could get started. I was starting to come around, but still had a fair amount of questions on this loan. The lender was a very difficult person to talk with and I just wasn't getting a good feeling. This is all new to me and I would frequently have to ask him to "dumb it down" for me. He would basically then just state the same thing over again in the same words. It was very frustrating. I work in an ER and it was basically like me telling someone with no medical training how to go in and perform a serious procedure only using medical terms. They would just look at me like I had 8 eyes...

2 days after that meeting, RJ called and said one of the original lenders we had talked to just called him and said they now offer 90% construction loans, meaning that I would only need to put down 10%. He asked if I wanted to go in and meet with the guy. I told him I would as I was having a rough time with the other lender. Jenny, our realtor, and I went and talked with him and he was great at explaining this process to a "newbie." I understood it first time through...all questions answered. On top of that, the loan is a conventional construction loan with no complications like the other loan we were working on. There is 1 closing cost at the beginning (which is small) and at the end it rolls into a fixed rate mortgage at whatever the rate is at that time. Currently it is 3.5%. There are 4 draws at $300 total for the draw fees, which is pretty good. For those new to this, a "draw" is when the builder takes money from the loan during the construction process for materials/labor. They typically do this 4 times throughout the project. Also with this loan, the builder has up to 6 months to complete the project, but this can be extended if needed. Some of the other loans we looked at had a 90 day completion time and you were penalized $100/day until it was complete! Be aware of this if you start looking into construction loans.

I feel like I will be accepting the terms of this loan and making it official within the week. However, I did ask our realtor to get with the other lender and demand solid numbers and schedules for when I will need to have cash on hand to pay for something. Unless he has some miracle to offer me, I can't see the benefit in going through with a much more complex loan with 2 closing costs instead of 1. Hopefully I hear back tomorrow...

Later this coming week when we have the financial situation smoothed out, RJ wants to meet with us to start discussing house plans and what goes on from here on out!

We have decided on a 2-story with finished basement. We love ranches, but they are much more expensive to build and given our budget, we would get much more house if we get a 2 story. We have 2 floor plans we've found online that are interesting to us and he has a handful of blueprints he is willing to show us that he has done before that would fit what we are looking for. We will make several alterations to each plan to make it truly custom to what we want. We then submit the plans to the designers and they will make the blue print for us. RJ says this typically takes 3 weeks. Then we give the blue print to the lender who will have our land and plans appraised and the building process begins! We are looking to break ground some time in March of this year.

As for where we are building...we have a lot on hold in an established subdivision in Burlington, KY. This means that we have 24 hours to decide to buy the land if someone takes interest in it and wants to buy it. It has been on the market for quite some time and this hasn't been an issue for us yet. Let's hope it stays that way until we get this deal closed! We hoped to find 1-2 acres in the Burlington area that weren't in a subdivision, but that is hard to come by in this area and it isn't cheap if you do find it. Our lot isn't our dream location, but the price is right and it is in a nice neighborhood. Plus this is our first house. We are saving about $15,000 by going with this lot vs a lot anywhere else of the same size in this area. Very reasonably priced!

Anyways, that is a long intro post so I will get going. I will update later in the week when we figure more out on the financing and discuss what happens in the meeting with the builder!

Here is what led us towards building a custom home:

We began our house search late last summer (July 2012). Jenny's former co-worker/friend now works as a realtor and has been with us since the beginning of the process. It started by looking at a few homes that were on the market. We saw some potential in some houses, but were just kicking the tires at first as we knew financially we wouldn't be ready to move on anything until late winter/early spring 2013. Throughout the process, we happened to look at a few foreclosed homes which normally would have been well out of our price range. We saw the potential in them, but ultimately couldn't get over the fact that almost each foreclosure we looked at had sat there for quite some time before being placed on the market and sustained significant water damage (in almost every one of them!). Some of them had been blatantly damaged by the previous owner on their way out. We can't imagine the feeling of losing your own home that you worked so hard for, so we can't say we were surprised.

Finally, our realtor set up an appointment to look at a new construction home that was placed on the market by a local "big builder." I won't use their name or any other builders name other than ours currently because I'm not trying to put anyone down. After seeing a new construction, we had a really hard time entertaining the thought of buying a formerly lived in home. We've seen a few that were well kept and didn't need much work, but the idea of being the first people to live in the house made it feel like it was truly "ours." We then spent the next couple of months talking with various "big builders" in the area and even designed a few houses with them. We narrowed out all but one of the big building companies and decided on one that was more local and had a great reputation for building durable homes. On top of that, my parents had lived in a home built by this company for the past 15 years without one problem in their home, so I knew the quality they produce. This builder also introduced the "Energy Star certification" process to us as well. At first, I thought it was just a sales pitch. Then I did some research on the actual savings you can earn on your utility bills by owning an Energy Star certified home. I even spoke with a couple who said that they went from a 1500 sq. foot home to an Energy Star certified home that was over twice the size of their own home and have never had a bill over $100. They said most of the time it failed to approach $70! We live in a 3 bedroom condo right now and it is very poorly constructed. Our last heating bill was $150...and we have the thermostat set at 67...and it never reaches that temp. From this point on, we knew we wouldn't be happy unless we had an Energy Star Certified home. Of course, the materials that must be used tend to run up the cost of building one of these homes, but we plan on being there for 10+ years and it should pay for itself plus add to resale value later.

Some of my co-workers had recommended building custom, but I didn't think we could afford it. Our realtor happened to know a custom builder that she recommended we meet with. By the time we met with him, we had spoken with 2 other custom builders and weren't making much progress with them. We weren't really sure what to expect and had all but decided to abandon the custom builder search for our first home and try that down the road for future homes. However, we agreed to meet and we had a completely different experience. For the first time during the home building process, we met a gentlemen who owns his own custom construction/rehabilitation company and he seemed like a genuine, honest guy. He owns RJ Homes, LLC here in Northern Kentucky. For the first time, we didn't feel like we were being coaxed into a situation where we had a very high likelihood of being screwed out of a lot of time and extra money. He only builds a handful of homes per year and we were able to see some of his work. We were very impressed and if we could budget it, were ready to move on. This meeting happened about 3-4 months ago.

Since then, we've been trying to hash out the financing. Since the market crashed, construction loans are hard to come by unless you have the full 20% down payment to throw at it. We only have about 10% we can put down for a down payment. On top of that, only small local banks tend to offer them. We tried several...and I mean several banks between RJ, our realtor, and ourselves making many phone calls. For the first 1.5 months, not a lot of luck. RJ then had the difficult decision to decide whether to call it quits or to decide if he was comfortable enough with the situation for him to take out the loan and have us buy it from him at the end. The risk to him if he took out the loan is that something falls through with the financing on our part and we are unable to buy it from him at the end...then he is stuck with a house that he didn't want and now has to sell. I am not going to pretend to know what way he was leaning, but we felt as though he may go through with it. Fortunately, before that decision had to be made, our realtor talked with a lender who said he could help. This was about 3 weeks ago. He knew a way where I only had to put a minimum of 3.5% down on the home at the end, but during the entire construction process, the full 20% of the cost of the home had to be "frozen" in an account with the bank providing the loan. Following closing of the house at the end, I could then retain my money and put as little as 3.5% down or however much I ended up wanting to put down. I intend on putting down 10%. That would work, but freezing the whole 20% was going to put us in a tight financial spot by not leaving us with much available money to live off of initially.

At this time, that was the only option as far as me taking out a construction loan. RJ, the lender, and I sat down and hashed out the details such as draw schedules, draw fees, closing (there were 2 closings in this construction loan...one at the beginning, and then another at the end when converting it to a mortgage...), and time constraints on the loan. RJ said it was sound on his end and if I worked out the details and was comfortable with it then we could get started. I was starting to come around, but still had a fair amount of questions on this loan. The lender was a very difficult person to talk with and I just wasn't getting a good feeling. This is all new to me and I would frequently have to ask him to "dumb it down" for me. He would basically then just state the same thing over again in the same words. It was very frustrating. I work in an ER and it was basically like me telling someone with no medical training how to go in and perform a serious procedure only using medical terms. They would just look at me like I had 8 eyes...

2 days after that meeting, RJ called and said one of the original lenders we had talked to just called him and said they now offer 90% construction loans, meaning that I would only need to put down 10%. He asked if I wanted to go in and meet with the guy. I told him I would as I was having a rough time with the other lender. Jenny, our realtor, and I went and talked with him and he was great at explaining this process to a "newbie." I understood it first time through...all questions answered. On top of that, the loan is a conventional construction loan with no complications like the other loan we were working on. There is 1 closing cost at the beginning (which is small) and at the end it rolls into a fixed rate mortgage at whatever the rate is at that time. Currently it is 3.5%. There are 4 draws at $300 total for the draw fees, which is pretty good. For those new to this, a "draw" is when the builder takes money from the loan during the construction process for materials/labor. They typically do this 4 times throughout the project. Also with this loan, the builder has up to 6 months to complete the project, but this can be extended if needed. Some of the other loans we looked at had a 90 day completion time and you were penalized $100/day until it was complete! Be aware of this if you start looking into construction loans.

I feel like I will be accepting the terms of this loan and making it official within the week. However, I did ask our realtor to get with the other lender and demand solid numbers and schedules for when I will need to have cash on hand to pay for something. Unless he has some miracle to offer me, I can't see the benefit in going through with a much more complex loan with 2 closing costs instead of 1. Hopefully I hear back tomorrow...

Later this coming week when we have the financial situation smoothed out, RJ wants to meet with us to start discussing house plans and what goes on from here on out!

We have decided on a 2-story with finished basement. We love ranches, but they are much more expensive to build and given our budget, we would get much more house if we get a 2 story. We have 2 floor plans we've found online that are interesting to us and he has a handful of blueprints he is willing to show us that he has done before that would fit what we are looking for. We will make several alterations to each plan to make it truly custom to what we want. We then submit the plans to the designers and they will make the blue print for us. RJ says this typically takes 3 weeks. Then we give the blue print to the lender who will have our land and plans appraised and the building process begins! We are looking to break ground some time in March of this year.

As for where we are building...we have a lot on hold in an established subdivision in Burlington, KY. This means that we have 24 hours to decide to buy the land if someone takes interest in it and wants to buy it. It has been on the market for quite some time and this hasn't been an issue for us yet. Let's hope it stays that way until we get this deal closed! We hoped to find 1-2 acres in the Burlington area that weren't in a subdivision, but that is hard to come by in this area and it isn't cheap if you do find it. Our lot isn't our dream location, but the price is right and it is in a nice neighborhood. Plus this is our first house. We are saving about $15,000 by going with this lot vs a lot anywhere else of the same size in this area. Very reasonably priced!

Anyways, that is a long intro post so I will get going. I will update later in the week when we figure more out on the financing and discuss what happens in the meeting with the builder!

Subscribe to:

Posts (Atom)